It’s difficult discover recognized getting less than perfect credit financing out of one lender. Luckily for us, there are various online lenders that provide personal loans to those having poor credit if elitecashadvance.com open online bank account no deposit any credit at all. They won’t make hard credit checks courtesy credit reporting agencies.

not, perhaps one of the most issues you can certainly do to evolve your daily life should be to replace your poor credit score. It is really not no more than providing funds and you can mortgages it’s about having the ability to rent a condo, lease an automobile, otherwise rating a career.

When you find yourself trying to alter your poor credit score, it will be problems. But we are here to aid! Here are some ideas on how to try and replace your less than perfect credit score:

- Repay most of the outstanding balances.

- Pay the bills promptly.

- Cannot open any new credit cards otherwise credit lines.

- Consult you to definitely loan providers eliminate bad statements from your listing (this might take some time).

For folks who struggle with this action and want money for emergencies, loan providers can help with compatible loan facts. Go here checklist and attempt to know what brand of mortgage will work for you.

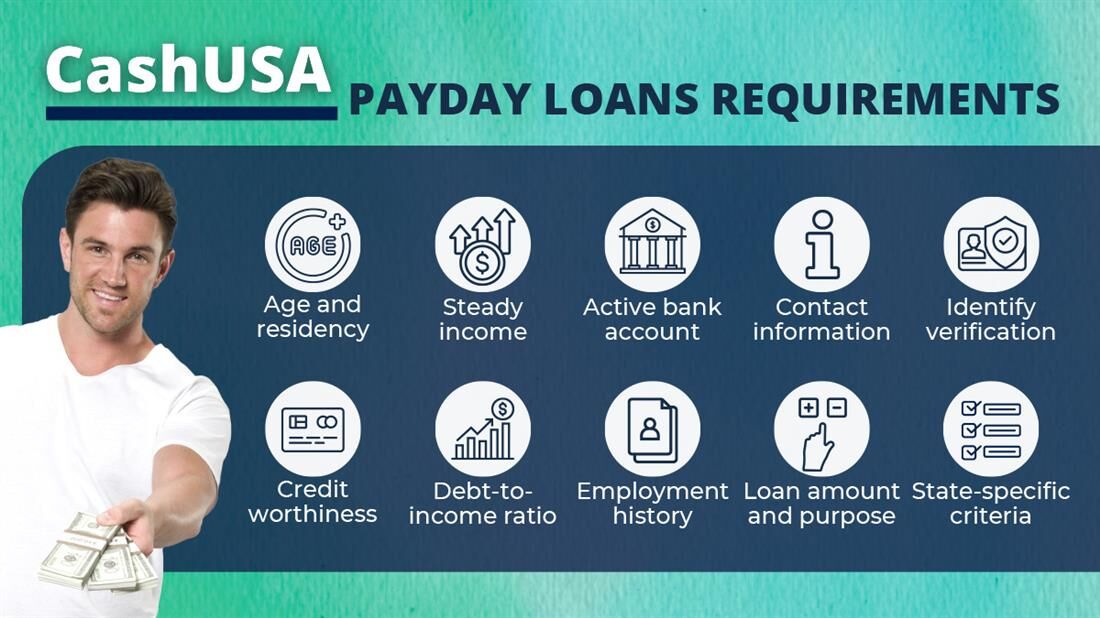

Payday loans

An instant payday loan are a primary-label loan which you can use to blow your own expense, pick restaurants and other necessities, otherwise build repairs towards the car. Pay day loan are made to help you to get owing to an economic emergency without the need to sign up for a lengthy-term financing otherwise bear a great deal more personal debt. New payday loan costs may be high versus long-label on line personal loans

Cash advance loans

Cash advance loans are brief-identity finance which exist out of an internet lender. These cash advances are meant to help you get as a result of a great crude area, and they’re usually used for problems or unforeseen expenses. You might acquire anywhere from $a hundred to $1,100000 at the same time. The loan terms of such cash advances are pretty easy: you don’t have to love rates otherwise repayment agreements you simply repay a full loan amount whenever you are able to.

Borrowing from the bank Creator Money

Borrowing creator funds is actually a variety of financing which will help you build up your credit score. If you are rejected for a financial loan or bank card before, this may be the answer you’re looking for. Borrowing creator finance are around for anybody who’s been rejected just before because of their credit scores. They make it easy to track down accepted for a financial loan by looking after everything from start to finish.

Pawn Store Funds

A beneficial pawn shop mortgage is a type of collateralized mortgage, for which you fool around with an item which you individual once the equity in order to see an initial-title loan. The thing are stored unless you pay the loan in full.

An effective pawn shop is a kind of business where you are able to simply take a product or service which you own and use it once the security for a loan. You will shell out desire to suit your lent currency, however, next months closes, you earn back their items as well as hardly any money left-over off the thing that was due with the loan. It’s also possible to love to sell the item downright as opposed to paying the loan.

Personal loans

An individual advance loan is a kind of unsecured otherwise covered financing having a certain objective and will be employed to buy expenditures, such medical will cost you or house home improvements. The debtor need a reliable credit rating to be eligible for personal loans. This is exactly a vital needs once the lenders conduct a painful borrowing from the bank evaluate thanks to credit reporting bureaus.

Leave a Reply