Could there be anything your 401(k) bundle can not would? Permits for taxation-deferred income in the conventional accounts and you will tax-100 % free money into the Roth-design accounts. And you can old-fashioned plans enable you to build efforts inside the pretax cash, helping decrease your taxable income. It even even offers a menu out of expertly handled opportunities from which to choose.

But there may be other ability of your own 401(k) (or an equivalent later years plan) that you haven’t believed: You may in reality be able to borrow cash from the membership. From inside the 2012, the fresh Personnel Benefit Browse Institute showed that 59% regarding 401(k) agreements which were surveyed considering loans to help you participants.

Have a look at Legislation Very first

The fresh Irs currently makes you borrow as much as fifty% of the full vested possessions on the account, around all in all, $50,000. There can be mortgage minimums and specific most other constraints, based on the plan’s certain loan supply computations.

This is how an excellent 401(k) financing works: The newest 401(k) recruit (your employer) sells the main plan expenditures from your membership equal during the value to the loan amount. Whether your 401(k) account is actually spent 70% inside a stock shared finance and you will 29% inside the a predetermined-income shared financing, the latest assets might possibly be bought in a comparable dimensions. The loan payments you create was reinvested within the whatever their then-current allocations was.

Currency lent for other objectives, for example another automobile, have to generally feel paid back in this 5 years. But not, you will be able to repay that loan taken to get a primary house more a longer time. Certain regards to the borrowed funds — regularity out-of payments and interest — will be determined by your online business, that could allow you to generate repayments on the that loan thanks to payroll deduction. Internal revenue service statutes want money as generated about every quarter.

See the Statutes Before you can Use

|

Consider the huge benefits .

For most, the key destination away from good 401(k) loan is the convenience and you can confidentiality maybe not essentially of a great financial otherwise finance company. And you can instead of banking institutions or other types of finance, there is no need to fear becoming rejected on the currency when borrowing from the bank of an effective 401(k) plan.

Various other benefit is competitive rates of interest, which are generally tied to the prime price. So it notice isnt tax deductible, although not, that can in reality “cost” your more additional sort of resource, like a home equity mortgage that may enables you to subtract attract. The eye you only pay to the plans mortgage happens directly into your 401(k) membership and certainly will upcoming continue steadily to build taxation deferred or taxation 100 % free to suit your much time-term demands.

. And you may Cons

If you are these gurus can make a retirement bundle mortgage enticing, there are some almost every other facts you should know. Earliest, whenever you are split up throughout the business through which your grabbed the mortgage one which just completely pay-off the bucks, you are needed to pay the balance within this 30 days or shell out government taxes inside it. You might like to become energized a ten% early detachment punishment from the Internal revenue service.

2nd, be aware of the possible “opportunity pricing” from borrowing from the bank out-of a great 401(k) bundle — the expense of any possible go back you’ll miss out on if the the pace toward financing is lower compared to account’s speed out-of return. Such as, for people who borrow funds out of a merchant account generating 10% and you also spend 7% focus on financing, your lose out on a prospective step three% get back into harmony of the mortgage. Over the years, the newest skipped income can add up and lead to a lesser harmony into the advancing years offers. Also, remember that returns in inventory and you may bond places are maybe not lingering — the typical return is often gained in some field spikes happening more a few days otherwise days. Whether your plan money is outside of the markets when men and women spikes exists, your chance cost might be higher than your questioned.

Also observe one charge recharged for old age package money by your company. In the long run, some organizations lay work deadlines for trying to get finance and can even get doing two months so you’re able to techniques the applying.

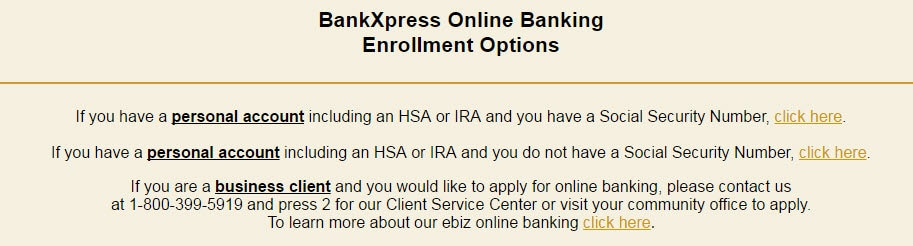

Questionnaire from 401(k) Preparations on the Package Finance

Make the most of Pension PackageThe main reason to purchase an employer-paid qualified later years plan, for example a great 401(k) bundle, will be to follow their long-title financial needs. Contemplate, the earlier your invest therefore the stretched you remain spent, the greater amount of you’ll probably benefit from taxation-deferred otherwise tax-free compounding. However, if you have amassed assets in your membership and you are for the demand for financing, a pension package was a way to obtain loans. |

Leave a Reply