- Exactly how many FHA money have you finalized?

- The length of time will you be operating FHA loans?

- Exactly how many numerous years of feel have you got given that a loan officer?

- Exactly what part of what is a flex loan line of credit brand new finance you matter try FHA finance?

- What’s the greatest difficulty to own obtaining acceptance to have a keen FHA loan?

- Precisely what do you strongly recommend I actually do to store the approval process swinging with each other?

- The length of time do you think my FHA application for the loan takes becoming processed?

- What is actually your prosperity speed to possess acquiring final recognition for the FHA mortgage candidates?

After you query the mortgage officer this type of concerns, ask for a good-faith Imagine. This will is an estimate of your own loan will cost you, for instance the interest rate, closing costs, title insurance coverage and you may fees. You can even need to measure the ideas of each and every financing administrator your speak with as well.

Your have earned a loan provider that provide you with lower will set you back and you will an effective customer care from the channel most crucial for your requirements, instance on the web or perhaps in-people, and you may financing administrator we would like to manage regarding the FHA financial techniques. From the CIS Mortgage brokers, our attributes may help help make your desire homeownership be realized.

How to get Pre-Approved having an FHA Financing

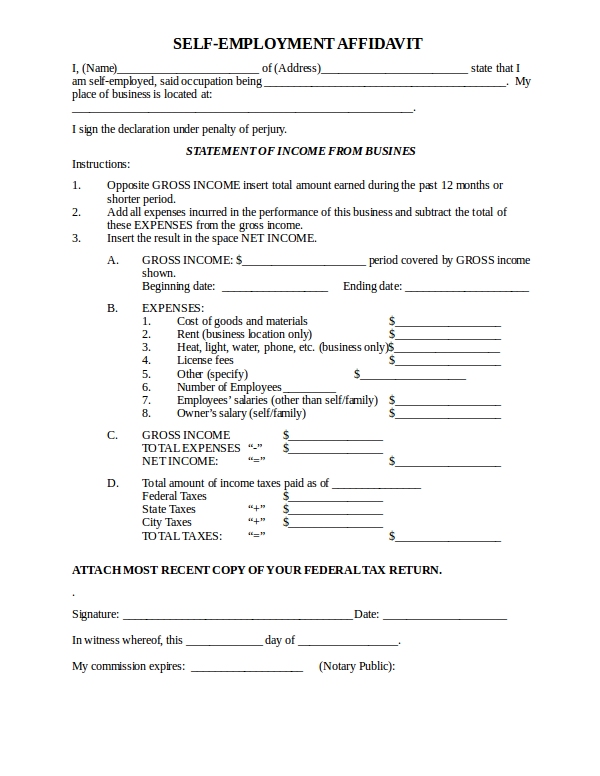

To get pre-accepted getting an FHA mortgage is a recommended action, it is strongly suggested. Pre-approval is the techniques whenever a lender critiques debt problem to choose regardless if you are qualified to receive a keen FHA financing and how far they’re able to lend your. This step is named pre-acceptance because occurs before house query that is maybe not formal approval to the finally mortgage.

Should you get pre-approved getting an enthusiastic FHA loan, you could establish a lending company has actually processed you, and display that it pre-recognition page having providers after you make an offer with the an effective household. A merchant tend to be more planning undertake your render when you’ve got a great pre-approval letter. When you is actually pre-accepted, you can start interested in a house in your spending budget.

How-to Make an application for an enthusiastic FHA Financial

When you come across property while making a deal, might complete a Consistent Residential Application for the loan, also known as Fannie mae function 1003, you will get fill in this form at the a unique phase of your own procedure. With this software, you are going to provide the possessions target and brand of financing you want. If the lender requires you to complete which application prior to when you look at the the method, particularly for the pre-approval phase, you’ll hop out the brand new line towards assets target empty.

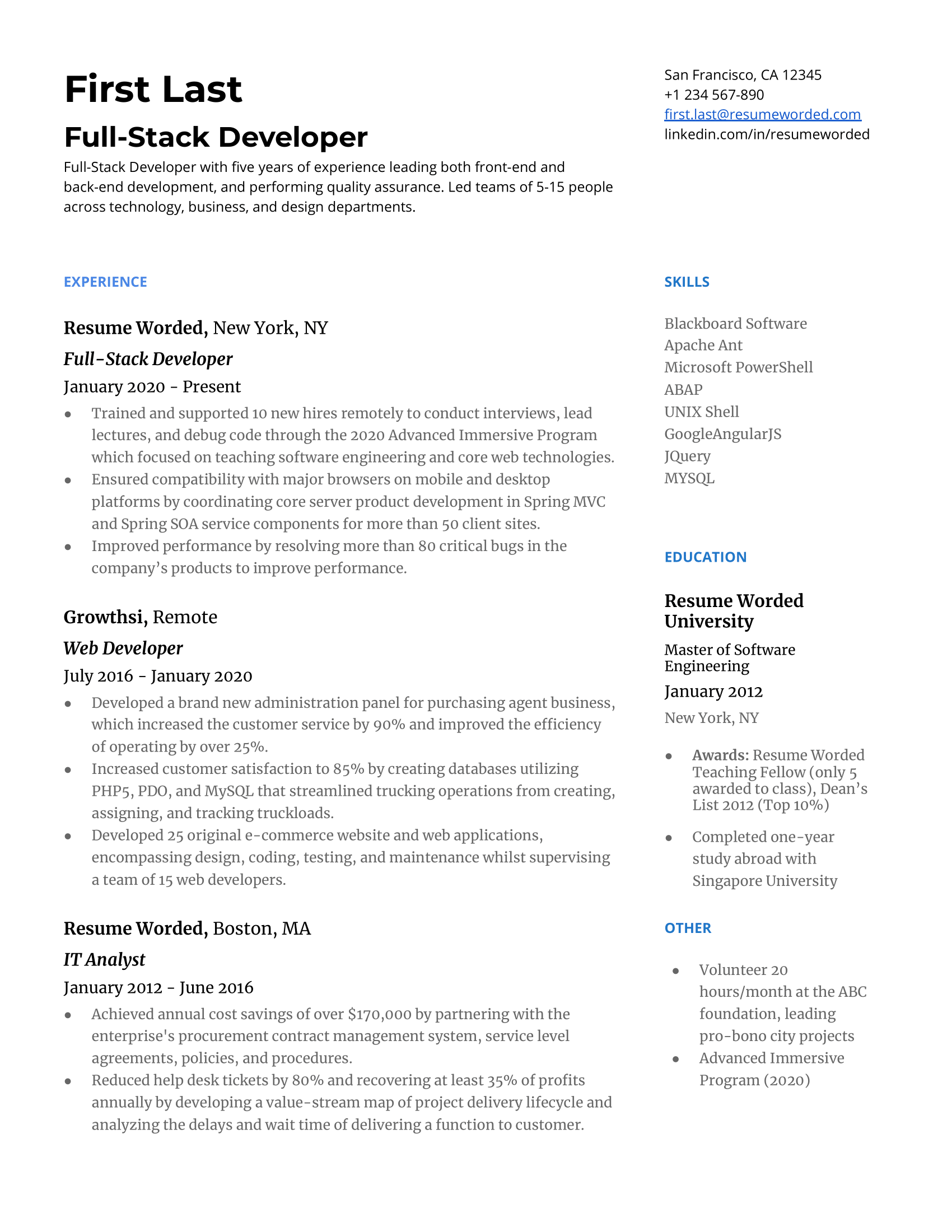

Finishing the loan application takes a while, and you will need to have a number of details about give, including:

- Continual expense

Tell the truth on the application for the loan and you can done they with the good your knowledge. At this stage, you are able to need to pay a fee for the borrowed funds application. Otherwise, your own bank include so it commission in your settlement costs, which you spend at the conclusion of the procedure.

cuatro. FHA Assets Check and you will Assessment

Once you’ve become accepted for an enthusiastic FHA loan, now what? Among next steps to buying a property that have an enthusiastic FHA mortgage try agreeing so you’re able to an FHA assessment by the a medication appraiser who’ll influence the worth of the house.

FHA Inspection Techniques

For those who have taken out an enthusiastic FHA mortgage, your house appraiser can do a home examination to choose whether the property match HUD’s minimal safe practices standards. New appraiser can get flag specific conditions that need to be corrected until the FHA loan is actually financed, for example:

Leave a Reply